21Shares Launches Canton Network ETP for Institutions

🕓 Estimated Reading Time: 5 minutes

Overview

In a significant development for the digital asset landscape, 21Shares, a leading issuer of cryptocurrency exchange-traded products (ETPs), has announced the launch of its new Canton Network ETP. This novel investment vehicle is designed to provide institutional investors with structured access to the Canton Network, a private, permissioned blockchain ecosystem tailored for financial institutions. The introduction of this ETP marks a pivotal step in bridging traditional finance with the burgeoning world of digital assets by enabling enhanced institutional blockchain capabilities.

The move underscores a growing appetite among sophisticated investors for regulated and secure pathways into the decentralized finance (DeFi) and tokenization space, leveraging the robust infrastructure of private blockchain networks. By facilitating exposure to the Canton Network, 21Shares aims to unlock new opportunities for capital deployment in a rapidly evolving market, addressing the demands for both innovation and compliance.

Background & Context

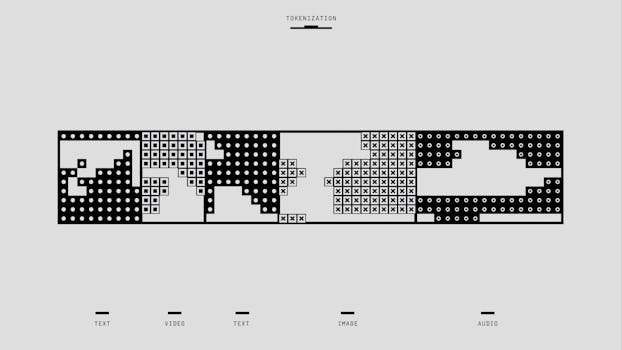

The Canton Network, developed by Digital Asset, is a groundbreaking interoperable blockchain network designed specifically to connect independent financial applications built on Daml, a smart contract language. Its primary objective is to enable seamless, atomic transactions across various applications and institutions, addressing long-standing challenges in cross-platform settlement and data synchronization within the financial sector. Unlike public blockchains, the Canton Network operates as a private, permissioned environment, ensuring that participants maintain control over their data and transactions while benefiting from the speed, security, and immutability inherent in blockchain technology.

The demand for structured digital asset investment products has escalated significantly in recent years. Traditional financial institutions often face hurdles in directly engaging with raw digital assets due to regulatory uncertainties, operational complexities, and the nascent nature of the underlying technology. ETPs, like those offered by 21Shares, provide a familiar, regulated wrapper that integrates digital assets into conventional investment portfolios, offering liquidity, transparency, and institutional-grade custody solutions.

The launch of the 21Shares Canton Network ETP signifies a strategic response to this demand, offering an indirect yet effective means for institutions to gain exposure to the growth and development of such critical blockchain infrastructure. It moves beyond direct exposure to cryptocurrencies, focusing instead on the underlying technology and its application in modern finance, specifically targeting the niche of inter-institutional cooperation via private blockchain access. This evolution represents a maturation of the digital asset market, moving from speculative assets to infrastructure-focused investment opportunities.

Implications & Analysis

The introduction of the 21Shares Canton Network ETP carries significant implications for the convergence of traditional finance and blockchain technology. For institutional investors, it offers a regulated and familiar investment vehicle to participate in the growth of a highly specialized and critical piece of financial infrastructure. This ETP does not provide direct exposure to specific cryptocurrencies but rather to the ecosystem built around the Canton Network, which is geared towards improving efficiency and reducing counterparty risk in financial markets.

Experts suggest that such products are crucial for expanding the reach of blockchain technology beyond speculative trading into fundamental financial operations. By investing in the Canton Network through an ETP, institutions can effectively back the development and adoption of interoperable private blockchain solutions without having to directly manage distributed ledger technology or navigate complex smart contract deployments. This mitigates many of the operational and regulatory risks typically associated with direct engagement in the blockchain space.

Furthermore, the ETP’s focus on a permissioned network like Canton emphasizes a trend towards regulated and compliant blockchain solutions for mainstream finance. This approach often appeals more to established financial players who prioritize security, privacy, and adherence to existing legal frameworks. The ETP simplifies the investment process, offering a liquid and easily tradable instrument that can be integrated into existing portfolio management strategies. This enhanced access to robust institutional blockchain infrastructure is expected to catalyze further adoption and innovation within the sector.

The ETP also serves as a barometer for institutional confidence in specific blockchain ecosystems. A successful launch and performance of this ETP could encourage the development of similar products targeting other enterprise-grade blockchain initiatives, further diversifying the landscape of digital asset investment opportunities beyond direct cryptocurrency exposure. It represents a vote of confidence in the future of tokenized financial instruments and the underlying technology that enables them.

Reactions & Statements

Hany Rashwan, CEO and co-founder of 21Shares, highlighted the strategic importance of the launch, stating, 'The 21Shares Canton Network ETP represents our commitment to providing sophisticated investors with exposure to the most critical innovations in digital finance. The Canton Network's unique approach to interoperable private blockchain solutions aligns perfectly with the evolving needs of institutions seeking efficiency, security, and scalability.' This statement, as reported by industry sources, underscores 21Shares' vision to lead in offering diversified digital asset products beyond traditional cryptocurrencies.

'This ETP offers a clear pathway for institutions to invest in the foundational technology that will drive the next generation of financial markets,' Rashwan added, emphasizing the product's role in democratizing access to cutting-edge blockchain infrastructure.

From Digital Asset, the developers behind the Canton Network, the sentiment is equally positive. Executives at Digital Asset have frequently voiced their belief in the transformative power of interconnected private blockchains for global finance. The partnership with 21Shares to launch this ETP is seen as a validation of their technology and a crucial step towards wider adoption of the Canton Network's capabilities among institutional players. The ETP is expected to create a feedback loop, driving further development and participant engagement within the network as capital flows in.

What Comes Next

The launch of the 21Shares Canton Network ETP is likely to inspire further innovation in the structured digital asset product space. As more financial institutions recognize the benefits of private, permissioned blockchains for specific use cases like interbank settlements, trade finance, and supply chain management, the demand for accessible investment vehicles will only grow. We can anticipate other asset managers exploring similar ETPs or funds that target enterprise blockchain solutions, moving beyond just direct cryptocurrency exposure.

Regulatory bodies worldwide are also closely observing these developments. The advent of products like the Canton Network ETP, which provide regulated access to blockchain infrastructure, could prompt clearer guidelines and frameworks for digital asset investment. This regulatory clarity is crucial for mainstream adoption and could pave the way for an even broader array of institutional offerings. The success of this ETP will be closely watched as a benchmark for how traditional finance can effectively interact with and benefit from advanced blockchain technologies.

Ultimately, this launch marks another step in the ongoing digital transformation of financial markets, where blockchain technology is increasingly seen not just as a disruptor but as an essential component for building more efficient, transparent, and resilient financial systems. The future will likely see greater integration of tokenized assets and services within existing financial frameworks, with investment products playing a critical role in facilitating this transition.

Conclusion

The launch of the Canton Network ETP by 21Shares represents a significant milestone in the evolution of digital asset investing for institutional clients. By offering a regulated and accessible pathway into a cutting-edge private blockchain ecosystem, 21Shares is facilitating deeper engagement between traditional finance and blockchain innovation. This product not only diversifies the range of digital asset investment opportunities but also underscores the growing importance of private blockchain access and interoperability for the future of global financial markets. As the industry continues to mature, such initiatives will be crucial in fostering widespread adoption and unlocking the full potential of distributed ledger technology.