Tokenized Gold Thrives in Crypto Bear Market

🕓 Estimated Reading Time: 4-5 minutes

Overview

In an era marked by significant volatility in the cryptocurrency markets, a unique asset class is demonstrating remarkable resilience and attracting increasing investor interest: tokenized gold. As major digital currencies grapple with sustained downturns, often referred to as a crypto bear market, the stability and intrinsic value of gold, now accessible on blockchain networks, are proving to be a compelling safe haven for both institutional and retail investors. This trend highlights a growing maturity in the digital asset space, where real-world assets are being leveraged to mitigate the inherent risks of pure cryptocurrency speculation, offering a bridge between traditional finance and the decentralized economy. The appeal lies in combining gold's centuries-old reputation for value preservation with the efficiency and transparency of blockchain technology.

Background & Context

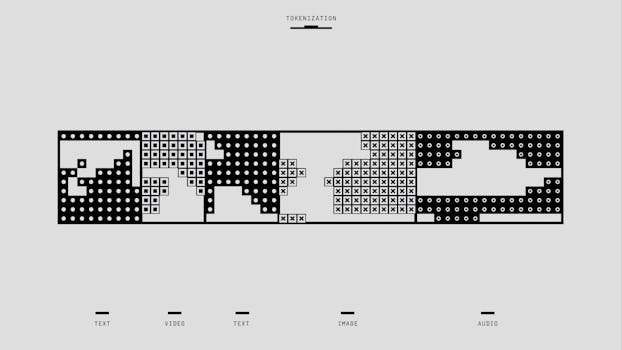

The global financial landscape has been particularly turbulent in recent years. High inflation rates, rising interest rates, geopolitical tensions, and fears of an impending recession have contributed to widespread economic uncertainty. Simultaneously, the cryptocurrency market, after experiencing unprecedented highs, entered a prolonged crypto bear market. Major cryptocurrencies like Bitcoin and Ethereum have seen substantial price corrections, leading many investors to seek less volatile alternatives. This environment has naturally steered attention towards assets historically known for their stability during crises, with gold standing out as a primary choice. Traditionally, investors would buy physical gold bullion, gold ETFs, or shares in gold mining companies. However, the advent of blockchain technology has introduced a new, more accessible method: gold-backed tokens. These digital assets represent physical gold held in secure vaults, with each token typically representing a specific weight of gold, such as one gram or one ounce. This innovation bridges the gap between the immutable value of a precious metal and the cutting-edge capabilities of decentralized finance (DeFi), offering a novel approach to asset ownership and investment in a digital age.

Implications & Analysis

The rise of tokenized gold during a volatile period underscores several key shifts in investor behavior and market dynamics. One primary implication is the strong demand for safe-haven assets in a high-risk environment. Investors are increasingly looking to hedge against inflation and market downturns, and gold's historical performance makes it an ideal candidate. The tokenized form offers distinct advantages over traditional gold investments. Firstly, it provides unparalleled liquidity, allowing investors to buy or sell fractional amounts 24/7 without the logistical challenges associated with physical gold. Secondly, it enhances accessibility, lowering the barrier to entry for smaller investors who might find direct purchases of bullion prohibitive. Thirdly, blockchain technology introduces a layer of transparency and immutability, with transactions recorded on a public ledger, reducing counterparty risk and ensuring verifiable ownership. This combination of gold's inherent value with blockchain's efficiency is why platforms are seeing increased activity. For instance, the appeal of digital gold is not just its perceived stability but also its seamless integration into the broader DeFi ecosystem, enabling collateralization, lending, and borrowing opportunities that are not easily replicated with physical assets. This flexibility and enhanced utility are powerful drivers behind its current surge.

Reactions & Statements

Industry players have noted the burgeoning interest in asset-backed tokens. Aurelion Crypto, a prominent entity in the digital asset space, has explicitly highlighted this trend. According to a press release from Aurelion Crypto, the ongoing crypto bear market is proving to be a significant boon for tokenized gold, with a noticeable shift in investor sentiment toward more secure, tangible assets within the digital realm. The company emphasized that gold’s enduring reputation as a store of value, combined with the technological advantages of blockchain, makes it an attractive proposition during periods of market uncertainty. Experts at Aurelion Crypto believe that investors are increasingly recognizing the merits of holding digital gold as a means to diversify portfolios and protect against the volatility endemic to speculative cryptocurrencies. This sentiment is echoed across various market analyses, which indicate that the market for precious metal-backed digital assets is experiencing steady growth, contrasting sharply with the downturn seen in much of the wider crypto market. The underlying narrative suggests that as the crypto ecosystem matures, the demand for assets anchored to real-world value will only intensify, driven by both risk-averse investors and those seeking innovative ways to combine traditional wealth with digital efficiency.

'The current market conditions are undeniably challenging for many digital assets, but they have simultaneously underscored the value proposition of tokenized commodities, particularly gold. Investors are seeking stability, and gold, in its digital form, offers that without compromising on the efficiency and accessibility of blockchain,' an analyst familiar with Aurelion Crypto's position stated, as reported by PR Newswire.

What Comes Next

Looking ahead, the trajectory for gold-backed tokens appears promising, irrespective of short-term market fluctuations. The increasing demand for crypto stability is likely to drive further innovation in the asset tokenization space. We can anticipate more traditional assets, from real estate to rare art, being tokenized and brought onto blockchain networks. Regulatory frameworks will play a crucial role in shaping this future. As more institutional capital flows into these digital asset classes, governments and financial bodies will likely introduce clearer guidelines, enhancing investor protection and fostering mainstream adoption. The long-term implications include a more efficient, transparent, and globally accessible financial system where asset ownership is streamlined and fractionalized. The ongoing integration of these assets into decentralized finance (DeFi) platforms is also expected to deepen, offering new avenues for yield generation and portfolio management. Challenges remain, including technological scalability and overcoming traditional investor skepticism, but the current momentum suggests that tokenized assets, especially those backed by stable commodities like gold, are here to stay and will likely carve out a significant niche in the evolving global financial architecture.

Conclusion

The emergence of tokenized gold as a resilient asset class amidst the current crypto bear market signals a significant development in the broader digital asset landscape. It demonstrates a growing sophistication among investors who are increasingly seeking tangible value and risk mitigation strategies within the crypto space. By combining the timeless appeal of gold as a safe-haven asset with the modern efficiencies of blockchain technology, digital gold offers a unique blend of security, liquidity, and accessibility. This trend is not merely a temporary reaction to market downturns but rather indicative of a fundamental shift towards asset-backed tokens as a viable and sustainable component of diversified investment portfolios. As the digital economy continues to mature, assets that provide genuine crypto stability, anchored to real-world value, will likely gain even greater prominence, bridging the gap between traditional finance and the innovative world of decentralized assets. The journey of tokenized gold serves as a powerful testament to the evolving dynamics of wealth management in the digital age.